Share Market

A prominent share market platform, catering to a diverse range of investors, sought to overcome challenges in executing trades efficiently, managing client portfolios, and providing real-time market insights. Manual analysis limited their ability to deliver timely recommendations, hampering their competitiveness in a fast-paced market.

Challenges & Potential

Navigating the Complexities of

E-commerce

Inefficient Trade Execution

Manual trade execution processes resulted in delays and inefficiencies.

Portfolio Management Dilemma

Ensuring secure trading experiences for clients was a top priority.

Real-Time Market Insights

The absence of real-time market data hindered traders’ decision-making.

Timely Notifications

Investors struggled to stay updated on market changes and portfolio movements in real-time.

Security Concerns

Clients lacked effective tools to monitor their investments and receive personalized recommendations.

Solution & Implementation

Pioneering Automation in

Share Trading

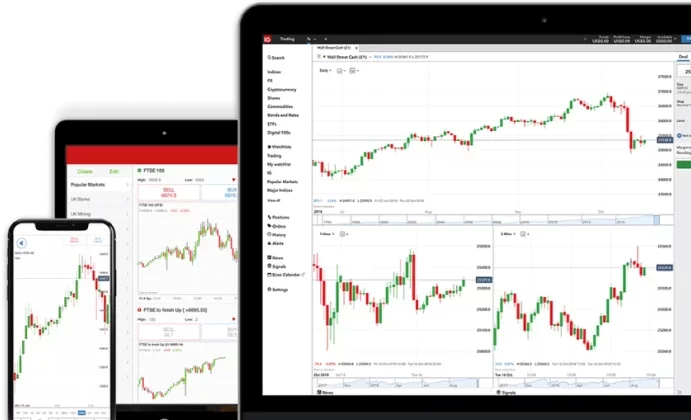

Automated Trading Platform

Introduced automation, enabling seamless trades, reducing manual intervention, and eliminating execution delays.

Portfolio Management Solution

Enhanced engagement with a solution for monitoring investments, tracking performance, and receiving personalized recommendations.

Real-Time Market Insights

Integrated real-time data feeds, empowering traders with up-to-the-minute insights for informed decisions and optimized returns.

Instant Notifications

Provided real-time mobile notifications for market updates, price shifts, and portfolio changes to keep investors informed.

Results

Revolutionizing E Commerce

1. Efficient Trading

Introduced automation, enabling seamless trades, reducing manual intervention, and eliminating execution delays.

2. Client Engagement

Enhanced engagement with a solution for monitoring investments, tracking performance, and receiving personalized recommendations.

3. Informed Decisions

Integrated real-time data feeds, empowering traders with up-to-the-minute insights for informed decisions and optimized returns.

4. Enhanced Accessibility

Provided real-time mobile notifications for market updates, price shifts, and portfolio changes to keep investors informed.